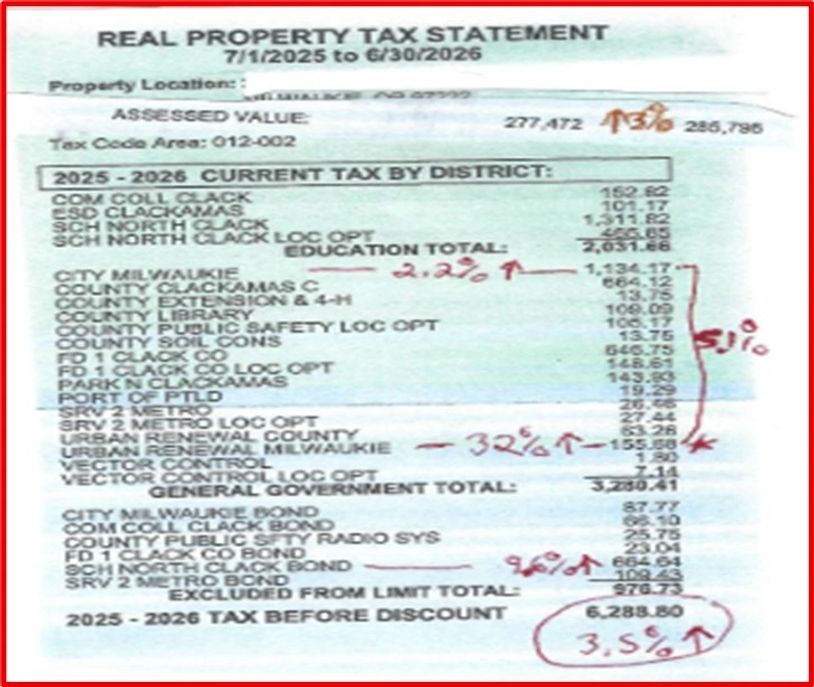

Milwaukie's Property taxe bill increases over 3.5%

Milwaukie's Urban Renewal property tax surges 32%, taking funds away from Milwaukie's police Dept.

The City of Milwaukie and its elected officials, like with other Oregon cities, constantly complain about property taxpayers not paying enough property taxes to the city government. But Milwaukie, like many other Oregon cities, fails to acknowledge that it is increasingly diverting its property tax proceeds into its urban renewal fund (which a few select City Council appointees get to dole out to their favorite developers/businesses or just sit on for decade after decade).

Look at the combined total of the City of Milwaukie's "City Milwaukie" property tax (2.2% increase since the November 2024 property tax bill) and "Urban Renewal Milwaukie property tax (32% increase) - which are shown above for the typical Milwaukie home which had no improvements this last year. When you add these two City of Milwaukie property taxes together, this total for Milwaukie is up over 5% since last November 2024.

So, the idea that the City of Milwaukie is limited to the three percent constitutional limit on increases in tax assessed value is crock.

Because the City of Milwaukie is putting more of its property tax proceeds into its urban renewal slush fund, its general fund budget for funding the police department is only going up 2.2%. So, what is the City Council of Milwaukie doing to make up for diverting its property tax proceeds away from its police department? It has already enacted a new water bill fee that will soon show up in your upcoming water bills. The City Council by a vote of 5 to 0, enacted this new fee without a vote of the residents of Milwaukie.

The Milwaukie City Mayor and Councilors are having to jack up the fees on Milwaukie water bills, also, because they are doing government subsidized "affordable" housing, which brings in new residents of Milwaukie - and these residents being in subsidized housing do not pay, or pay very little in, property taxes. The Mayor and Councilors push poor people migrating into Milwaukie, which means more people and more crime, with existing middle income (and above) tax/fee payers stuck having to pay more to make up for the poor people not paying property taxes or water bill fees, to maintain their police services.

The Milwaukie Mayor and Councilors also gladly spent millions of taxpayer dollars, over the last five to 7 years, on a futile attempt to materially change the temperature of the earth (the so-called climate change mind virus affecting Oregon's leadership and a culpable electorate).

Then there is the Oregon Public Employe Retirement System (PERS) which takes more and more of City government budgets just to keep an overgenerous public employee retirement system afloat. The surge in PERS costs for cities like Milwaukie flies under the radar. Two governors earlier in this century (Kitzhaber and Kulongoski) tried to lower public employee retirement benefits to be more in line with what is sustainable in terms of funding, but they are mostly unsuccessful.

And that my friends, is the rest of the story - an untold story - about Milwaukie's so-called projected budget deficit.

(posted by Elvis Clark on October 24, 2025.)

Milwaukie property tax bills go up 2.9% this November 2024

Over the last ten years, Milwaukie property tax bills rise 4.0% per year - higher than inflation

Two important details on the City of Milwaukie's share of property tax bills.

(1) The City of Milwaukie property tax charge only increases 2.2% in the last year, November 2024 from November 2023 - the $1,110.12 figure in the above table photo of a typical city of Milwaukie, Oregon 2024-25 property tax bill. This line item, "City Milwaukie" property tax, represents the monies used by Milwaukie's government to fund basic services, like police, library, and general city community activities.

A 2.2% rate of increase in revenue for Milwaukie government's basic services is less than half the increase in the costs of providing Milwaukie's basic services - the City Council handed out wage and salary increases this year of some 5%, for instance.

(2) The reason that the city of Milwaukie's basic services' property tax revenue only grew 2.2% in this fiscal year is because Milwaukie's Urban Renewal District is bleeding tax proceeds away from the City's basic services budget. Urban Renewal is a tax not on property owners, but it is a tax on the City's basic services (the line item "City Milwaukie" in the above property tax bill photo).

Milwaukie's Urban Renewal property tax share increased 43%, November 2024 from November 2023. If "City Milwaukie" and "Urban Renewal Milwaukie" property taxes are added together, the City of Milwaukie's total combined share of property taxes increases 5%, November 2024 from November 2023.

The bottom line is that the City of Milwaukie needs to stop its Urban Renewal District from taking so much from the City's share of property taxes for basic services. It could do some of this by removing the Milwaukie Market Place and the new 7 Acres Apartment complex in Central Milwaukie from the City's Urban Renewal District. I remind readers that Milwaukie's Urban Renewal District was passed by a vote of the City Council itself, and not approved by the voters of Milwaukie.

So, now what Milwaukie faces is the risk of losing basic services like police at the same time the city rezones most of Milwaukie to allow for a higher number of residents - a higher number of residents no doubt leads to increased demand for Milwaukie basic services. So, Milwaukie's basic services budget runs behind the increased demand for basic services from an increasing city population.

This is what happens when the electorate votes pie-in-the-sky-types onto the City Council, ignoring the follow-on consequences of these elected pie-in-the-sky officials to request pet projects, euphemistically called by the City Manager as Council goals.

(posted by Elvis Clark on October 30, 2024.)

Metro wants to keep property taxes it could return

Measure 26-244 asks voters -this May's Primary Election- to let it keep returnable property taxes

Measure 26-244 is criticized by Willamette Newspaper for not using existing property tax proceeds to first fund more affordable housing units, instead of funding more unspecified Zoo projects. Metro runs the Oregon Zoo located in the west hills of Portland.

Some of Metro's existing property tax bonds are maturing which frees up Metro to either lower its property taxes, allowing it to either reduce property tax rates or to use in other ways if approved by voters - Willamette Week supports using the property tax bond savings to go towards more affordable housing projects (giving higher priority to people than animals).

Here's Willamette Week's Nigel Jacquizz interviewing Metro Councilor Lewis and others about why Metro is choosing to fund animals (the Zoo) and not people (Housing):

Should Oregon Zoo Upgrades Come Before Low-Income Housing? (wweek.com)

(posted by Elvis Clark on April 12, 2024)

Oregon legislature shelves its proposed new property tax

Nearly 1,300 Oregonians showed up at the state capitol to testify against a new state property tax

Thanks to the Oregon Taxpayer Association. The Taxpayer Association organized against House Bill HJR 201, a legislative proposal to create a new state-wide property tax. The Taxpayer Association sent out 14,000 mailers alerting its members of the property tax increase proposal (HJR 201). As a result, nearly 1,300 Oregonians came to the state capitol and testified against HJR 201. Word is that after the testimony of all these Oregonians in opposition to HJR 201, the legislature has shelved HJR 201 (so, a new state-wide property tax is probably dead for this year.)

This new state-wide property tax would have broken the state constitutional limits on property tax increases.

Here's the link to the Oregon Catalyst report on the rallying of opposition to HJR 201 (a new state-wide property tax):

1,270 testify against Statewide Property Tax (HJR 201) | The Oregon Catalyst

(posted by Elvis Clark on February 17, 2024)

Annual Property Tax Bill goes up 5.25% - this November 2023

For Milwaukie Homeowners, the newly arriving Property Tax bill increases 5.25% vs. last year's bill

The Oregon constitution limits yearly increases in property taxes to 3%, unless voters approve an extra property tax (local option) for a government operation, or an extra property tax to cover a government construction bond. This last May 2023, voters in the Clackamas Fire District approved a new line-item property tax (FD 1 Clack Co Loc OPT in the photo above). (Milwaukie is in the Clackamas Fire District jurisdiction.)

This is why the newly arriving property tax bill for the current tax year (2023-2024) is more than a 5% increase over last year's property tax bill in total - instead of the usual constitutional limit of 3%.

Notice (from the property tax bill example in the photo above) that the Urban Renewal District of Milwaukie took 28% more from property taxpayers this year than last year, thereby reducing Milwaukie City government's General Fund for basic services. Urban Renewal is best understood as a diversion of property tax proceeds away from normal government operations into a special fund for developing an area.

Also, note that the North Clackamas School District Local Operating Levy (Sch North Clack Loc Opt in the above photo) is up for voter approval in this November 7, 2023, special election.

The above property tax bill example is close to the average bill charged Milwaukie homeowners. North Clackamas School District's Operating Levy that is up for voting this November 7, 2023, costs the average homeowner in Milwaukie over $400 per year (its the $439.11 in the above property tax bill example).

Over last ten years, Milwaukie property tax bills have increased an average of 4.5% per year.

The largest yearly increase in Milwaukie property tax bills occurred in the tax year 2019/2020 when the North Clackamas School District's extra operating property tax levy is first approved by voters in the School District. (Milwaukie is in the North Clackamas School District.)

(posted by Elvis Clark on October 27, 2023)

Property taxpayers pay $50 to Metro for inaccessible parks

Metro's own auditor finds that Metro regional government's promises made to voters to provide generally publicly accessible parks in return for approving a Metro parks property tax...are not being kept. In fact, a vast amount of the land bought with property tax monies by Metro remains inaccessible for most all of the public. Metro spent nearly $500 million to purchase land and then effectively lock it away for years on end.

For Clackamas Review newspaper's reporting on this Metro government failure, read the pdf just below "MetroNoPark23Aug."

(posted by Elvis Clark on August 9, 2023)

MetroNoPark23Aug (pdf)

Download

This year's Property Tax Bill for milwaukie is up 3.6%

Oregon's Property Tax laws set a 3% limit on annual property tax bill increases with some important exceptions. The biggest exception to the three percent limit on increases is that City and County voters can approve tax increases for new public construction projects and special operating levels to supplement government general funds.

For this year's property tax bill, the Clackamas County sheriff Office increased its special operating levy (also named "County Public Safety Loc Option") by some 53% over last year's special operating levy tax rate (see above example of a break out of Milwaukie's property taxes by the government jurisdiction receiving the tax proceeds). Clackamas County voters approved this increase in the Sheriff's operating levy in May of 2021, and it is just now taking effect.

The other large percentage increase in property tax charge is that of the Clackamas College Construction Bond. I am not sure why this went up by some 56% - this year bill over last year's bill. Bond related property tax charges can fluctuate because of the timing of the financing term of the associated public construction bonds.

In the above breakout of property tax charges for Milwaukie property owners, you see a 14.9% increase in the Urban Renewal Milwaukie charge. Increases in Milwaukie's Urban Renewal Property tax charge do not increase the property tax bill in total , because Urban Renewal takes from the City [of] Milwaukie charge (the $491.81 charge in the above property tax break-out). Hence, the City of Milwaukie's property tax take for its General Fund (Basic Services like Police funding) increases this year by less than the normal limit of 3% rate of increase. Urban Renewal monies go towards assisting developers in building new buildings, mostly in Milwaukie's Down Town. This arrangement is scheduled to last until the year 2049. After 2049, the new buildings are thought to boost Milwaukie's general fund substantially. But in the mean time, existing Milwaukie residents could be said to be sacrificing a full funding of their basic City services such as police, library, public maintenance, and other discretionary City services.

Over the last ten years, Milwaukie Property Owners have seen their property tax bills increase 4.2% per year on average. This rate of increase includes a number of public construction bond taxes and special operating levies which have been approved by voters over the last ten years.

The other major exception to a property owner's property tax bill is if the property owner remodeled or makes new additions to their property. In this case, property owners with such improvements to their property see their property tax bill increase also for the added value of these improvements - as assessed by the County Tax Assessor. The tax does not increase at the same rate as the increase in the assessed value of the property, but is adjusted down by the County's average percentage of Real Market Value of homes versus their tax limited assessed value. In the case of Clackamas County this percentage discount is about 60%.

So, if your home remodel adds $100,000 in market value to your home, then the Tax Assessed Value of your home only increases by $60,000 (60% applied to the $100,000 in improvements). So if the total property tax rate is $20 per $1,000 in Tax Assessed Value, this property owner would see their total tax bill increase by some $1,200 per year for remodeling their home.

(posted by Elvis Clark on October 27, 2022)

Freezing property taxes for all seniors asks for trouble

Property taxes are allowed to increase 3% per year on all Oregon properties under Oregon law

The thing we should fear about Initiative Petition 10 (Freezing Oregon Property Taxes to current levels for all Oregon Seniors over the age of 65) is that there is likely to be a counter proposal to undo Oregon's current property tax limits which save Oregonians thousands of dollars each year on average on their property taxes.

Those who oppose Oregon's current property tax limits, approved by Oregon voters in the year 1996, want property owners to pay property taxes based on the market value of their home/property rather than the tax assessed value of their property. For Clackamas County, the average property/Home has a market value two times greater than its tax assessed value limit.

So, the counter reaction to Initiative Petition 10, could very well be effectively hiking the average property tax bill by thousands of dollars per year.

On top of this, many seniors who own their home/property are pretty well off. For those seniors who are having a hard time meeting their property tax bill, the state of Oregon does have a property tax deferral program for seniors. One problem with this deferral program is that it charges 6% interest cost per year to the seniors on the amount of property taxes they defer. Seems like those that want property tax relief for Seniors would be better to launch an initiative petition which would lower the interest rate charged for senior property tax deferral.

(posted by Elvis Clark on September 16, 2022)

Milwaukie's Property tax bill for the typical home owner increases 3.2% from last year's property tax bill - A few important comments

Oregon assessed value is limited to 3% per year increases. (e.g of Milwaukie's property tax line items to the right here.) But if voters pass special property tax levies or bond tax projects (like new School buildings), then property taxes can increase faster than 3% in any particular year. It looks like the North Clackamas School District bond approved for renewal last November 2020 results

My Clackamas Review Newspaper article against Measure 3-566

Just below is my article against the Sheriff's Public Safety Property Tax Increase (Measure 3-566). See ClackRevw21Apr3566.

(posted by Elvis Clark on April 30, 2021)

ClackRevw21Apr3566 (pdf)

Download

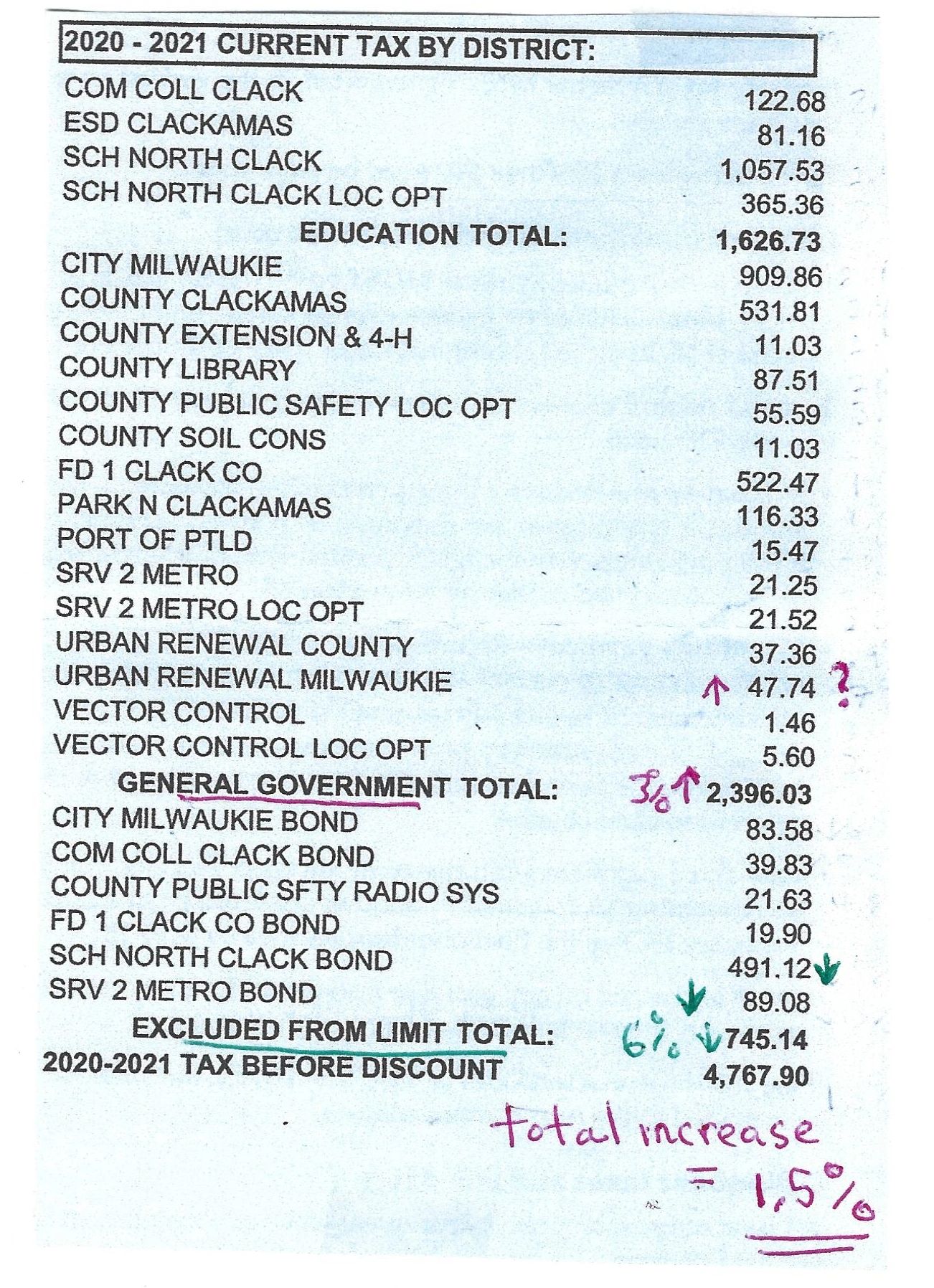

Notes on this year's property tax bill for Clackamas County

The Urban Renewal Milwaukie line item property tax charge nearly doubles from last year (? mark in above photo). I contacted the Clackamas County Tax Assessor's office for an explanation. It turns out that it is in line with how urban renewal generally works. What happens with urban renewal is the properties placed into an urban renewal area by a City Council - for instance much of down town Milwaukie is in its urban renewal area - the properties in this area are taxed the same as other parts of the City. However, once properties are put into an urban renewal area, the normal three percent increase in property value assessment for the urban renewal properties gets siphoned to a special urban renewal account. The City can use these funds to subsidize further development and construction within this urban area.

The ultimate consequence for property tax payers is other City government property tax rates are reduced from the normal rate of 3% increase. So, for instance, the City Milwaukie line item in our property taxes increases by about 2.4% from last year's City Milwaukie line item property tax charge. Without urban renewal, this line item for Milwaukie government would have increased by the limit of 3%.

The down side to urban renewal is that City General funds increase at less than 3% per year, as the difference between 3% increase rate and this year's 2.4% (City Milwaukie charge) flows instead to the City's urban renewal slush fund...err excuse my French. Often the consequence of urban renewal is to under fund basic services like police, parks, city wide sidewalks and streets in some cases, etc. If the decrease in basic services becomes significant, then a lot of times City Councils go on to enact additional new taxes and fees on City residents.

So, in conclusion, urban renewal tends to short City provided basic services and other discretionary city expenditures. In the case of Milwaukie, the City Council I believe gave a property tax exemption to the newly constructed Axle Tree mixed use Apartment complex in Milwaukie's down town urban renewal district. This took a chunk of the Axle Tree's property value off the property tax rolls.

This didn't cause City Milwaukie line item property tax charge to increase. But had the Axle Tree not been granted the property tax exemption (lasting some ten years); then maybe the City would have had more urban renewal funds or if urban renewal were ended; then the City would have more money for City services.

As it turns out, Milwaukie's commercial real estate agent is saying mixed use apartment complexes like the Axle Tree may not be financially sustainable in years going forward. As the cost of new construction is unaffordable for prospective renters. Then too, the Orange line down town is suppose to be an attractive feature for down town development; but Covid-19 and the increasing attractiveness of ride sharing services is making transit oriented development like the Axle Tree look less important and financially viable. There is also a trend towards working at home, which tends to require more living space in your housing unit....not so conducive to small apartment units.

________________________________________________________________________________

In other notes: As long as your property tax payment is post mark by November 15, 2020; you still receive the 3% discount on your property tax bill. It doesn't need to be received by November 15, 2020. It just needs to be mailed by then and post marked accordingly. The actual due date this year is Monday November 16, 2020; because November 15th is a Sunday. I am not sure you can get a post mark on a mail-in payment on Saturday November 14th. So, probably should get it to the post office by this Friday November 13th.

I watched a property tax webinar hosted by Clackamas County's Tax Assessor office this afternoon. I will post a link to this webinar on Thursday, when it becomes available supposedly.

(posted by Elvis Clark on November 10, 2020)

Not too bad of increase in this year's property taxes (1.5%)

Milwaukie's urban renewal charge almost doubles but taxes for bonds decrease helping mitigate

The question I want to pursue with the City of Milwaukie is why its charge for urban renewal nearly doubled from last year. Milwaukie's urban renewal district is mostly its down town area. What an urban renewal district does is too freeze the urban renewal district area's property taxes, rather than increasing them at the 3% maximum rate of increase allowed under the state constitution. To make up for the lack of increase in property tax revenues from the City's urban renewal district area, the rest of the City is charged to make up the difference.

I am wondering if the granting of a ten year property tax exemption to the latest new building down town, the Axel Tree Apartments, might not have caused the rest of Milwaukie to be charged more under the Urban Renewal Milwaukie line item.

Elsewhere, we are getting some relief from construction bond property tax items, such as the North Clackamas School District Bond line item. This might be due to the old debt expiring and the replacement bond having a lower interest rate cost for property tax payers.

Well the above tabulation of property taxes assumes you didn't add any significant new construction/remodeling to your home. The home is largely unchanged in size and other attributes counted by the County appraiser for taxable real estate value.

There is one measure on this November election ballot which is said to raise the average home property tax bill by $45 per year beginning next year, and this is Measure 3-564, "Children Safety Services." I did not like how the current Clackamas Board put this Measure on our ballots. The public is largely unaware of this Measure, even as the deadline for putting it on our ballots is within two weeks of the Board approving it for the ballot. The so-called non-profits pushing for this property tax levy came in literally like at the last minute to pressure the Board to place this on the ballot. County staff even had to drop any mention of an administrative cost cap on administering these charities. Now the charities really act as a tax arm of the County.

Oh, the tax man...let's not end on such a sour note....here's a video comedy clip from "It's a Mad, Mad World" in which a group of money hunters who are on the trail of some buried bank robbery monies talk of how they can divvy up the loot once they find it and the subject of taxes comes up:

https://www.youtube.com/watch?v=vZ0B_5N28vY

(posted by Elvis Clark on October 25, 2020)

Last Year's November 2019 Milwaukie Property Tax Bill more than 12% higher than year before bill

Two particular reasons for this year's sharp increases in property tax bills for most Milwaukie home owners. (1) A new tax charge for helping fund operations at North Clackamas Schools, and (2) Metro's SRV Bond nearly doubles from last year's charge. These two reasons are starred in the above property tax bill - that of an average valued home in Milwaukie.

The nearly doubling of the Metro bond tax stems from voter approval of Metro's affordable housing bond in last November 2018 General Election.

The new North Clackamas School District Local Option ('Operating Levy') is also approved by voters in the November 2018 General Election. But I would add this comment:

Originally before this Operating Levy is put on the November 2018 ballot, North Clackamas School budget document said most prominently the need for this new Operating Levy tax is because the Oregon Public Employee Retirement System (PERS) is eating up increasing portions of public school budgets. As last November's election approached, however, North Clackmas School District seem to hide its original assessment for the need for an operating levy; thus downplaying the PERS 'black hole' causing a large amount of recent school funding woes state wide, including in Clackamas county.

Property tax bills spiking over 12% definitely negatively affects the affordability of homes and apartments.

You - the voter - now has before you a request by Metro to renew its bond property tax another five years, costing the average property tax payer $50 or more per year. Given the spike in property taxes faced by Milwaukie homeowners and indirectly renters, I recommend voting NO on Measure 26-203.

(posted by Elvis Clark, 10/19/19)

An early example of Costly Government housing programs

See attached PDF below about Costly 'Affordable' Housing Property Tax Program

Costly Government Affordable Housing PDF HERE:

In the case of affordable housing, I think we would be better off keeping our taxpayer dollars and giving them to rather low cost charitable home builders some of whom can build a new small home for as little as $100 per square foot, if the government would only not keep land supply locked up and building codes especially stringent.

CostlyAffordbleHsg (pdf)

DownloadElvis' short paper on a proposed increase in Property Taxes

State Senator admits PERS will use up much of any new school funding

Sen. Elizabeth Steiner Hayward, D-Beaverton, who is a Senate co-chair of the Joint Ways & Means Committee, said lawmakers were serious about controlling expenses. That could include merging, consolidating or eliminating state agencies, commissions and boards, although she declined to say which ones might be under consideration.

Getting schooled on PERS: Steiner Hayward affirmed a truth about the Oregon Public Employees Retirement System. PERS' unfunded actuarial liability will eat up a big chunk of any increased education spending dedicated to reducing class sizes or lengthening the school year.

(from David Hughes, reporting for Oregon Capital Insider, 1/24/19, "Capital Chapter: It's deadly quiet."

(posted by Elvis Clark on 1/25/19)

Potential Spike in our Property Tax Bills, starting in the year 2021

I received property tax data from the Clackamas County Tax Assessor's Office today. As I posted below a few days ago, there is a proposal now in the Oregon Legislature (SJR2, it is called) to raise the Assessed Value for property owners state wide, Assessed Values would be raised to be at least equal to 0.75 of a property's real market value (the price the assessor estimates a house could sell for).

Turns out the average ratio of most home owners in Clackamas County is only about 0.65. This means SJR2 would raise most homeowner's tax bill by ((0.75 divided by 0.65) minus 1)*100....or 15%.

But for a chunk of homeowners the increase in property tax would be sharply higher than this. According to the Clackamas County Assessor's Office, There are 27% of home owners whose ratio is only 0.60 or lower. For these the increase in property tax bill is more on the order of 25%.

Then there are about 15% of home owners whose ratio is only 0.55 or lower. For these folks, the increase in property tax bill would be greater than 35%.

Imagine you are a young couple, or family, who just recently bought a house with a ratio of only 0.55; and you took out a mortgage which is assisted to some degree by the existing relatively low property tax bill. Now all of a sudden the state comes along with SJR2; and causes your property tax bill to jump over 35% in the course of a few short years (SJR2 has a 5 year ramp in). These young home owners could see their property tax bill increase in absolute dollars by $1,500 or more per year, if the house has an average assessed value $200,000 to $225,000.

Now for these young homeowners with mortgages, who just recently purchased a low ratio home, how equitable is this SJR2 state legislature property tax proposal? NOT VERY I WOULD SAY.

Fortunately, SJR2 if it is to take effect is requiring a vote of approval by Oregon voters at the year 2020 General Election.

(posted by Elvis Clark 1/17/19)

Property Tax Bills may be sharply hiked by Oregon state Soon

Ratio; tax assessed value of typical Milwaukie single family detached home versus its real market value (RMV) as of the 2018/19 property tax year 55%

How the Oregon Legislature could sharply raise our property taxes, this coming November 2019

Oregon Senate Joint Resolution 2 (SJR2) if enacted would raise the ratio of Assessed Value (AV) to Real Market Value (RMV) to be equal to no less than 0.75. In the tax bill shown above for a typical like Milwaukie single family home, this ratio for this property tax year (2018/2019) is only about 0.55. SJR2 would thus hike our property tax bills in this case by 36% in one year (0.75 divided by 0.55, then minus 1), just in the stroke of a pen. I took a look at real properties in Milwaukie per Milwaukie's city budget from last June, and it shows an average ratio of 0.59 for all properties (residential, commercial and industrial). In this case, SJR2 would hike property taxes for our entire area by an average of 27%. For Clackamas County as a whole, a typical single family home could see SJR2 hike its property taxes by nearly 16%.

I definitely will go to Salem to testify against SJR2 if it proceeds to public hearings, because this could be an extra $1,000 to $1,500 per year in new taxes for many Milwaukie area homeowners. Ouch!

(posted by Elvis Clark 1/11/19)