Gold price goes bonkers & Stock Market too

This Week (10/22/25), the price of gold reaches nearly $4,400 per ounce

Central Banks overseas are said to be buying gold, adding to their stockpiles of gold; while the U.S dollar loses some of its exchange value against a global basket of currencies (for example, the Euro).

The U.S dollar could be in decline because U.S interest rates are expected to decline - this, after the last three years in which there is a spike in U.S interest rates to fight inflation.

A host of other factors are probably involved in the spike in gold prices this year (Gold is up over 50% since the start of Calendar year 2025).

Major economies that are at odds, or in unfriendly alliances with the U.S, like China, are trying to center their trade increasingly not in U.S dollars but with a basket of currencies in loose ties to the price of gold. These are the so-called BRIC nations.

The U.S is increasingly using its global financial prowess, something it won in the aftermath of being victorious in World War 2 - some 80 years ago now. The U.S threatens to remove Russia (a member of the BRIC nations) from the global western world international banking system. China, also a BRIC nation, is wanting to increase its global power status by reducing the use of the U.S dollar as the world's dominant currency reserve or means of international banking.

A couple of weeks back I evaluated what maybe the price of gold should be based on the inflation that has accumulated over the last ten years, and I came up with a corresponding gold price of about $3,800 to $3,900 per ounce.

So, this year's spike in gold prices may be about done. After hitting nearly $4,400 earlier this week, the price of gold - as of this post on Friday morning October 24, 2025 - is around $4,150.

Part of the surge in gold to $4,400 this week may have been due to Jamie Dimon of the big dog bank, Chase, saying gold could be on its way to $5,000 and maybe even to $10,000 soon.

Meanwhile the U.S stock market is in a steady upward trend - is it overvalued?

Back at the end of last January 2025, I forecast based on long term trend (time oriented statistical regression, covering the period of 1950 through 2024)...that the stock market should end up around 5,500 for the S&P 500 stock market index by January 2026.

Well, at this point, the S&P 500 index is way above 5,500 with its value being about 6,800 (the black star in the chart just above), as of this morning October 24, 2025.

So, the stock market today is some 20 to 25% over its long-term trend value. Maybe the stock market is also catching up with accumulated inflation over the last several years, or maybe it anticipates higher inflation as the U.S attempts to deflate the burden of its growing national debt.

There is also a huge amount of optimism about the productivity gains that will flow through to company profits because of artificial intelligence (AI) technology. This, plus, Trump's Big Beautiful Bill allows for much faster tax write offs for businesses, also, adding to forthcoming profits for businesses. Bigger profits tend to boost stock market prices.

As a side note on AI:

I am at a city meeting last evening and it is using artificial intelligence to generate the "minutes" for the meeting. The minutes will be reviewed for accuracy by the meeting's secretary. I have to note, though, that there is some thought among those using artificial intelligence technology, so far, that AI is being overhyped. One of AI's shortcomings, that is becoming apparent, is that it tends to hallucinate in its answers to complex questions.

(Pause.)

(Woe, as the world spins. Do you ever wonder about what Heaven will really be like? Like does time exist in Heaven? Artificial intelligence says the biblical scholars are not very certain that it does or doesn't. My wish is that God does create a form of time in heaven, so that our spirits are not actually in a frozen state.)

(posted by Elvis Clark on October 24, 2025)

Trump tested the stock market with tariffs, then softened

U.S stocks sold off as Trump heralded (tariff) Liberation Day but then pulled back - stocks rally

This last Friday (June 27, 2025) the U.S Stock Market made a new record high, at 6,173 for the S&P 500 Blue Chip Stock Market Index. Back during the days of high tariff rhetoric (mid-February to early April), by Prez Trump, stocks had sold off to a low of just under 5,000 for the S&P 500 Index.

Trump's Treasury Secretary spoke to Trump, at the market low point, saying to him that the stock market sell off was getting too carried away for the U.S economy to not suffer a dramatic slowdown; and so, Prez Trump delayed and softened the tariffs - that are now being gradually implemented at lower levels than originally proposed.

(posted by Elvis Clark on June 30, 2025)

My Longterm equation says stocks decrease 9% -next 12 months

Every year at the end of January I project how the stock market will fare over the next 12 months.

As the chart above shows, my long-term trend equation is projecting that the benchmark stock market index, called the S&P 500 index, will decrease about 9% from the January 31, 2025, closing value of 6,040 down to 5,500 on January 31, 2026 - a 9% decline in stock prices.

Most other major stock market indexes follow the trend in the S&P 500 index over the course of several years or less.

Stocks increased 24% between January 31, 2024, and January 31, 2025. So, my time trend forecast shown in the chart above calls for a cooling off year for stocks after some hefty gains the last two years, and especially after this last year of 2024.

President Trump's tariffs might slow prices, including stocks prices, as trade flows may be slowed considerably by the tariffs and other countries retaliating with their own tariffs against U.S exports - softening the economy. A softer economy, though, would bring down mortgage interest rates.

(posted by Elvis Clark on February 1, 2024)

Gold is increasing in concert with rising U.S National Debt

Central Banks around the world are said to be hedging their holdings of U.S Debt with gold reserves

With the U.S National debt continuing to increase steadily with massive trillion-dollar federal deficit spending, those who buy U.S Treasury debt/bonds, like foreign central banks, could be hedging a portion of their U.S treasury holdings with physical gold purchases. This is thought to be increasing the demand for physical and paper gold reserves, just in case the U.S federal government tries to inflate away its debt held by individuals and foreign countries, or even God forbid actual default.

On a side note, Oregon is heavily dependent on federal government deficit spending for propping up its economy and social safety net with federal monies flowing to the state. If the federal government ever is forced to become more frugal, Oregon will be in a world of hurt economically and socially. This lack of independence/resilience by Oregonians from government assistance is a profound weakness of the state - a state dominated by Progressive politicians for more than ten years now.

Since the first of this year 2024, the price of gold is up 35% while the stock market as measured by the S&P 500 index is up 22%.

(posted by Elvis Clark on October 23, 2024)

Federal Reserve cuts interest rates - Sep 18, 2024

U.S Stock Market sets new record day after Fed rate cut - a cut much anticipated for several months

The Federal Reserve on September 18th, 2024, cut its bank lending interest rate (known as the Overnight Federal Funds rate).

This is the first step the Fed is making to loosen the monetary strings after two years of hiking its interest rate in response to hyper like inflation in the years 2022-23.

Easier money is usually good for the stock market as it reduces corporate borrowing costs and makes the stock market more rewarding than investing in bonds and money market funds.

24/7 Emergency EMilwaukieOr.Org Services

The Federal Reserve (the U.S Central Bank) cut its bank lending rate by 0.5 percentage points to just about 5.0% from 5.5% (annualized percentage).

The Federal Government itself will benefit because it will lower the interest rate that the Federal Government pays on its massive debt pile.

Will our Congress politicians only take these interest rate savings and spend them - ignoring the mounting national debt? Both presidential candidates seem to want to continue spending federal monies lavishly.

Spending big works until it doesn't - then maybe big hangover or inflation is the payback.

(posted by Elvis Clark on September 20, 2024)

This has been a tremendous stock market so FAR this year-'24

The U.S Stock Market Benchmark, the S&P 500 big company stock index, is up 19% for - year-to-date

The S&P 500 passive stock market index started the year just over 4,700 and this week on Wednesday July 10, 2024, it closed at over 5,600 in value.

My long-term time trend equation says the current S&P 500 stock market is overpriced by 20% (described in a section below here), but it is only predictive over long periods of time; and there may be plenty more upside before there is a bear market stock market correction.

The stock market seems to have been anticipating the decline in inflation and start of interest rate cuts by the Fed by increasing in value in the last several months and more. These two factors are good for stocks.

But wouldn't you know it: The day the stock market gets the good inflation news, Thursday July 11, 2024, it falls in value - reflecting the old stock trading proverb: "Buy on the rumor and sell on the news."

(posted by Elvis Clark on July 11, 2024)

After a good year, stocks projected flat next 12 months

The Stock Market rose 19% over the last 12 months. My equation projects slight dip - next 12 months

Each year at this time (end of January), I update my time trend equation for projecting the S&P 500 stock market (big U.S publicly held stocks) benchmark index and use this updated equation to project the ending value of the S&P 500 index value 12 months from now. My time trend equation is projecting a value for the S&P 500 Index on the close of trading on January 31, 2025, of 4,650.

Since today's (01/31/2024) closing value of the S&P 500 index is 4846; my time trend equation is essentially projecting a 4 % decline in U.S stocks for the next 12 months ahead - ending January 31, 2025.

My time trend projection for stocks is not meant to tell people how to invest, but just for background information. My trend equation can be off quite a bit for any 12-month period - being 5 to 10% off routinely -either too low or too high in various years.

Stocks are a long-term investment - meant to held for ten years or more. Historically stocks are a higher returning investment than bonds. So, if you feel comfortable with your current stock market allocation, you might continue to just hold. You will earn some dividend income from just holding a broad set of S&P 500 stocks. This tides you over until the stock market breaks out and goes higher.

If you come into some more savings, there is also the strategy of buying stocks when and if the stock market drops 5 to 10%. It is a presidential election year which can spawn a lot of up and down movements in the stock market. (Again invest at your own risk, I am not providing investment advice here.)

(posted by Elvis Clark on January 31, 2024)

I Bond, Saving Bonds, are an inflation hedge plus

Each individual may buy I Bonds up to a total of $10,000 in a calendar year.

I bonds have significant benefits for people wanting to save money, outside of retirement accounts. First, I bonds are an inflation hedge as they pay their holders for accumulated inflation, as measured by the U.S Consumer Price Index, when the bonds are cashed in. Second, they also pay in addition to inflation, a fixed rate of interest. This fixed rate is currently 1.3% per year. If inflation averages 2% per year, then the combined interest and inflation rate paid to holders of I bonds will be 3.3% per year (1.3% plus 2%).

Other benefits: I bonds are not taxable by the state of Oregon. The federal tax on the interest and inflation payout can be deferred until the bond is cashed out.

Another advantage of I bonds is that if in the rare event there is a decline in prices, deflation or negative rate of inflation, then the I Bond Face Value will be the payout (In other words, there can be no negative combined payout).

You can buy I bonds through Treasury Direct: Log In — TreasuryDirect

(Posted by Elvis Clark on December 3, 2023)

I bonds become more attractive with a positive fixed interest rate component

A disadvantage of an I bond is that if you cash out an I Bond in the first five years of its issue, you forfeit the last three months of the combined interest and inflation payout.

More importantly, I bonds will probably not return as much as being invested in the stock market. But they are very safe and nonvolatile in value.

Another disadvantage of I bonds is that you can only buy $10,000 in anyone year.

In the chart above, you see the history of new issue I bond fixed interest rate. If you buy an I bond between now and the end of April 2024, you will earn at least 1.3% per year for as long as you hold the I bond (except you lose three months of this interest if you cash out in the first five years of the bond. I bonds can be held for 30 years, after which they pay no interest or inflation adjustment.)

New issue I bonds for many years in the last decade paid 0% fixed rate of interest and just had a payout for whatever the inflation rate is. So, the current fixed interest rate of 1.3% (in chart above) is a little above average for I bonds historically. You want to have some fixed rate of interest on an I Bond because it will help pay for the federal income tax when you cash it out. When you cash out the I-bond the realized income will be somewhat of a bump up in your federally taxable income, and so you may have to cash out in stages in and around the 30 yearend date, in order to manage your overall income taxes.

The U.S Stock Market long trend projects a 20% Gain for 2024

My Long term Trend Equation forecasts a 20% gain for U.S stock prices over the next 12 months!

Historically, the U.S Stock Market grows about 7.5% per year, on average. This last year the U.S. Stock Market fell about 10%. My Long term Trend Equation had forecast a 7.5% fall in stock prices over this last twelve months. So, the Long term trend did pretty good in forecasting this last year's stock market performance.

Stocks also pay dividends, and this is about 2%. This 2% dividend yield is added to stock price appreciation to calculate total stock market return. So My Equation projects a typical yearly gain in stock prices of 7.5%, and to this a 2% dividend yield is added for a total stock market investment return typically of 9.5%.

The 20% gain in stock prices projected for the next 12 months by Long term trend is possibly explainable. The Stock Market's all-time (S&P 500 Blue chip company index) closing high is just about 4,800 (January 3, 2022) against the current index value of about 4,050. So, in a way, the Long Trend Equation is just projecting a little more than a return to the Stock Market's all time record high.

Once the Federal Reserve stops raising interest rates, the stock market is poised to rally; and especially if China successfully re-opens its economy from its Covid lock downs.

(posted by Elvis Clark on February 3, 2023)

.jpg/:/)

Quite Amazing: Stocks are up 5% since the start of year 2020

It's kind of an odd recovery in the stock market since the low posted back on March 22nd of this year, when the initial Virus shutdowns take effect. The current market is being carried by some selective industries, such as Home Depot, Amazon and Walmart companies; and big tech companies like Apple, Microsoft, Facebook, and Google. Some sectors are actually down significantly for the year. This is your oil and conventional energy companies. Plus banks, airlines and jet making companies are down too.

So, this is a case where you are safest in broader diversified stock funds, as you could be flat-to-down if you are heavily invested into energy, airlines, and banks. Of course, you are probably joyously dancing if you are invested heavily in big tech companies with brand name.

At this point, the stock market seems about ten percent too high, against my long, long time trend equation projection. And maybe with the approaching Presidential and Congressional elections things might get volatile for stocks once more this year.

(posted by Elvis Clark on August 21, 2020)

Goldman Sachs a week ago forecast a bottom of 2,450...hope they're right

Goldman Sach's a week back or so predicted stocks would hit a low of about 2,450 for the S&p 500 stock market index (graphed above) this Spring (spring hasn't even got here yet), and then begin a slow rebound and eventually recover to the 3,200 level by the end of this year. Hope they are right about this recovery. If it turns out this way, that would be a positive 29% return from where the S&P 500 (stock market) is today.

Crossing fingers for this pandemic to slow in its acceleration, very soon.

(posted by Elvis Clark on March 12, 2020, PM)

.jpg/:/)

Stock Market is down 19% since record high on Feb 19, 2020

Corona Virus is causing sales of goods and services to decline, not good for corporate profits.

The S&P 500 stock market index, the standard benchmark for stock professionals (not the Dow Jones), should be a good long term (multiple year) investment if it goes down to around 2,550 from its closing level today of 2,747,

At 2,550, the stock market will be down 25% from its closing high of 3,386. Should be a good buying opportunity. In fact, even today's level of 2,747 is got a really good chance of yielding 12% in gain by the end of next January 2021...based on my long, long trend equation.

A mother lode of stock market index buying would be if the S&P 500 market index falls to the 1,700 range. This would represent a decrease of about 50% in the stock market from its record closing high of 3386. In the last 20 years, the stock market is only fallen 50% from its high, twice. Once in the year 2003 and again in the year 2009. Big returns followed from these levels within a few short years.

A lot rides on the world authorities getting a grip on controlling the Corona Virus. A vaccine is probably not available until late summer or Fall this year. But return of summer heat in late Spring and Summer might give a period of respite. One OHSU doctor I talk to says maybe we won't find a good vaccine, just as with most flus and colds.

But I am optimistic this Corona Virus will too pass, and economies will steady and grow at least modestly going forward. This is our history, after all.

So, good luck to all, except those who want to kill free markets and free spirits (not the booz kind, either).

(posted by Elvis Clark on March 9th pm, 2020)

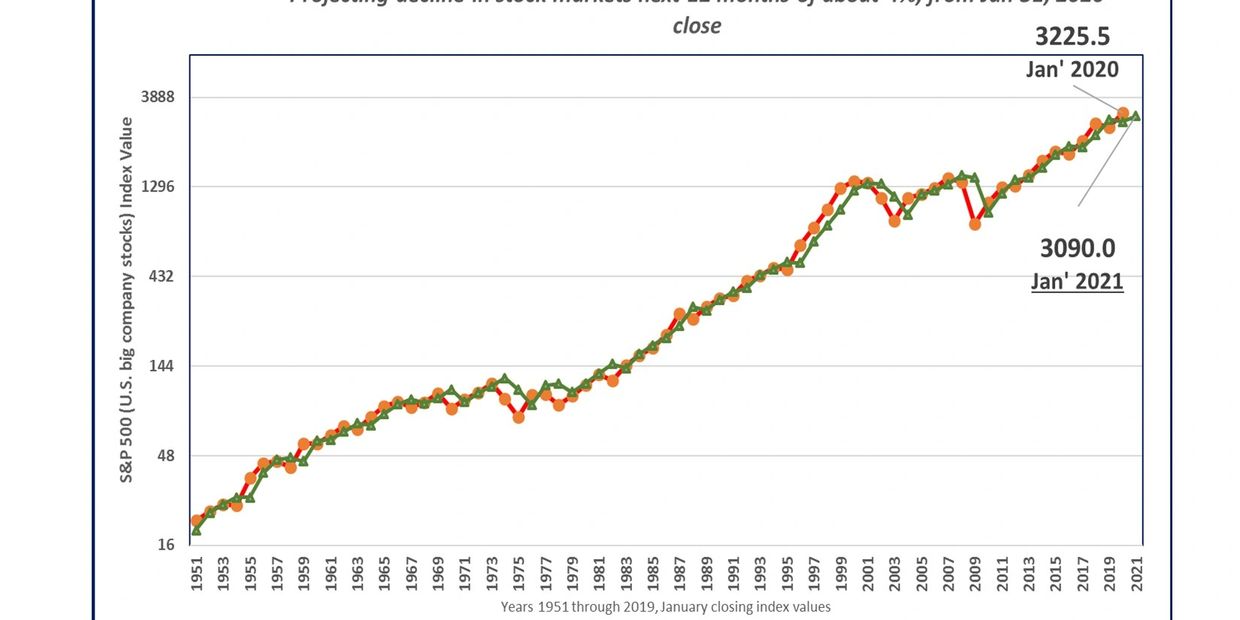

Over the next 12 months, U.S stock market prices down 4%

Charted above is the stock market index for the U.S. 500 largest public traded companies

The way I intend to use this trend equation projection is to invest more in stocks in the next twelve months when the S&P 500 index falls between 8 and 10 percent below current level of 3,225.5.

This is the first buying tranche threshold. As the market gets to between 13 to 15% less than current value, you add more to stock market holdings. You create these buying targets measured by the S&P 500 index value versus today's close of 3,225.5 all the way down to a 50% drop in the stock market (if such were to occur - which upon rare, short bouts, such occasions do occur).

This is my approach to re-balancing an investment portfolio between stocks and cash/liquid holdings.

Of course, nothing is hardly guaranteed with this approach...so you need to maintain some degree of portfolio investment diversity. If investing just based on S&P 500 bench mark index value, then you invest in passive stock market indexes....rather than individual stock company shares.

A really good book to read and study, to keep from going too wild in investing, is the book "Black Swan" by Nassim Nicholas Talib.

Japan is a curious case of where the stock market is flat for decades on end. So using a time trend for U.S stock market investing is going with the direction of current long, long term momentum, and hopefully we in the U.S don't experience a major long term correction like that in Japan.

(posted by Elvis Clark on January 31, 2020)

U.S Stocks are 5% over long term trend equation projections at this point.

If you are diversified, 5% is probably not enough to justify selling off some stock now. However, I might sell off a tad tomorrow. Eventually, there is what you call a "correction," or reversion to the mean.

(posted by Elvis Clark on January 16, 2020)

The U.S Stock Market is up about 20% for the year (2019) - year to date

My Long, long term stock market time trend equation projects the S&P 500 stock market index to increase to a value of 3,160 by the end of this coming January 2020. This would represent an increase in the stock market of another 4% between now and the end of this coming January.

Tomorrow is important for the near term trend in stock prices. The Federal Reserve (Fed) is expected to cut short term interest rates by one quarter of one percent. If the Fed signals it is likely to continue lowering interest rates, then the stock market probably continues its steady upward climb.

The Fed will brief the public on its sentiments for making further interest rate cuts, at 11 am to 11:30 am Pacific Standard Time, 10/30/19.

(posted by Elvis Clark 10/29/19)

Simple Time Trend projects 17% increase in U.S. Stocks over the next 12 months to Jan 31, 2020

Once a year at the end of January, I run a statistical regression against time with a one year adjustment for cycles. This is a simple method and use at your own risk. The long term time trend, dating back to 1950, indicates the stock market will make up for the decline in U.S stocks over the last 12 months (the S&P 500 big company stock index is down 4% since January 31, 2018) by increasing nearly 17% over the next 12 months (January 31, 2020). The standard error of this equation would have the S&P 500 index (U.S big company stocks) finish in the 2400 to 2600 range for a low case (market today closed at an index value of 2704, by comparison). And the standard error produces 3,600 to 3,700 for a high case.

See chart immediately below

(posted by Elvis Clark on 1/31/19)

Simple Long term Time Trend for U.S Stock Market Index

Stock Market Prices now about 10 % below long, long term trend line

The stock market finished down today by more than 2%, and since peaking in mid-September of this year is now down nearly 20%. For the year it is now down nearly 15%.

The Federal Reserve and politics seem to have removed optimism from stock market investment.

If the the Fed were to signal it is pausing and not planning to raise interest rates this next year, the stock market probably stabilizes if not rebounding. Former Federal Reserve Chair Greenspan would probably be stepping in to stabilize the market if only he were still in charge. But there is no such indication from current Federal Reserve leadership.

Current stock market prices seem like a good level to invest/buy. I can see the stock market falling another 6 to 7&, which would make for a stock market decline of 25% from peak values. There have been declines of up to 50% in the first decade of this century, but these discounted periods are very short lived with prices rebounding sharply afterwards.

Oregon's Public Employee Retirement System is adversely affected when stock prices in general fall like they have so far this year. So, how state government deals with a ballooning deficit in its PERS systems is key to how taxes go in Oregon.

Stock Market market is becoming a buyer's market (12/20/18)

The Stock Market is down nearly 16% from its peak in mid-September of this year. Stock Market prices in general are about 5% below long, long trend line; meaning they are slightly cheap to buy.

The stock market seems to be selling off in recent weeks because the Federal Reserve is raising short term interest rates. Higher interest rates are less favorable to global economic growth, which in turn hurts profits for big U.S companies with sales overseas.

I think the Federal Reserve may have to slow down on increasing interest rates, as slow global economic growth is causing inflation to slow. The Federal Reserve in raising rates is starting to hurt U.S housing construction demand and also automobile demand.

It doesn't seem like the stock market should drop 50% from its high as it did in the early 2000s with the Tech bust, or in 2008/2009 with the financial crisis.

If it drops 25% from its high, stock prices in general would decline another 10 percent or so from today's level. This would be a great stock investing opportunity I should think if this should come about.

(posted by Elvis Clark 12/20/18)

Two Stock Market graphs: 1) short term 2) Long term

1/2